Why The Mattel/Hasbro Merger Will In All Likelihood Not Happen - has | Seeking Alpha

There are a number of factors arguing for the economic benefits of this merger - cost synergies, supply chain economics, enhanced market position, better negotiating leverage, greater license opportunities - but it appears that the forces arrayed against it are too powerful to let it go through. These anti-merger forces are, in short, the top Mattel (NASDAQ:MAT) executives themselves, the Mattel shareholders, Disney (NYSE:DIS), the European Union and the national buyers of the leading retailers.

Mattel Executives

With the exception of Richard Dickson [the COO] and Peter Gibbons [EVP and Chief Supply Officer] all other top executives have two things in common. One is that they do not know toys from a bar of soap and the second is that they have just been hired and are complete greenhorns as far as their new employer is concerned. This includes the entire top floor - starting with Margo Georgiadis, the CEO, who came on board from Google in February and who in turn hired the CFO, the CTO, the Chief HR person and the Chief Communications Officer in the last few months. They all know that they are toast if taken over since they have nothing to offer which Hasbro does not already have in abundance.

As a result, they will fight tooth and nail to thwart this merger.

Shareholder Opposition

Whilst you would assume that the owners of Mattel shares should be overjoyed to have Hasbro buying the company, this is a fallacy. Yes, they would be happy if the price offered would be somewhere close to what the company's share price was only a year ago. If it is not, you can expect very aggressive pushback from shareholders. To quote a much more knowledgeable person than I - "Both companies would benefit from a merger, but Mattel stockholders might oppose a deal that values the company on its depressed stock price," said Erik Gordon, a professor at the University of Michigan's Ross School of Business.

To put numbers to this issue - on October 30, 2017, when the rumors first surfaced, the share price stood at $13.12 and this compares to the $30.46 a year earlier. It is unlikely that Hasbro will in fact be able to even get close to this number since there are three significant factors not yet included in the most recent Mattel Balance Sheet. One is the ToysRUs bankruptcy where Mattel's pre-chapter receivables stand at $135 million. People at ToysRUs have mentioned that they do not see a settlement of pre-DIP receivables at much more than 25 cents in the Dollar. If accurate, and if Mattel had no insurance to cover this loss, they could be hit to the tune of $100 million.

The second factor is the MGA Entertainment lawsuit against Mattel. The jury trial in connection with the Trade Secret Misappropriation case is scheduled for next year and, given the recent history of the case, there is a good chance that MGA will win again. Given the fact that MGA's claim is for about $ 1billion this could materially affect next year's earnings.

You have two mandates colliding. Mattel shareholders will expect a very high price per share because this is what the company is inherently worth given its brands, its retailer reach worldwide, its supply chain skills, its sales expertise, and its many pretty undervalued other assets. On the other hand, Hasbro shareholders will expect a price that takes into account real earnings and real cash flow over the next twelve to twenty-four months and this means a very low number.

In short, expectations and reality may just not be compatible in this particular case.

Opposition from the side of Disney

Disney has consistently opposed any move from the side of Hasbro that could reduce its leverage over its main licensee. This has been shown very clearly on two occasions. One was Hasbro's attempt to buy DreamWorks Animation. This was at the same time the negotiations regarding the transfer of the Princess license were ongoing. Disney made it very clear that this transfer was not going to happen if Hasbro persisted in its efforts to buy DreamWorks. Not so surprisingly, Hasbro stopped them and thus got the Princess license. The second time this happened was this year when Hasbro was thinking of buying Lions Gate. Lions Gate is the largest and most successful film studio in North America and its acquisition would have given Hasbro access to film making and hence film licenses independent of Disney. Disney also vetoed this particular deal.

A merger with Mattel would give Hasbro access to major Warner IPs now held by Mattel - Superman, Batman, Wonder Woman, DC Super Hero Girls, Justice League, Fantastic Beasts - and hence would again represent an alternative to Disney's movie brands. It is very likely, therefore, that Disney would also in this instance do everything in their power to stop this merger.

Antitrust Opposition

There is the possibility that the Federal Trade Commission would, under the current Administration, oppose the merger but I rate this as somewhat unlikely given their ongoing crusade against regulations affecting business activities. .

No, the real veto lies with the European Union and the possible merger of Hasbro and Mattel would clearly be in the province of the EU Competition Directorate headed by Margrethe Vestager. The criterion is that any merger between two companies in a horizontal or vertical competitive relationship, with sales worldwide exceeding Euro 5 billion worldwide or an EU wide turnover of each of the two firms of Euro 250 million or higher, would be investigated by the EU Commission rather than the Monopolies Commission of a member State.

There has been a recent example for what can happen, albeit on a much smaller scale and hence restricted to the Authority of a member State - the United Kingdom - in the case of the Leapfrog/VTech merger. Firstly, the U.K. Competition and Markets Authority ordered that any activity designed to merge the two companies had to cease and be reversed until a final finding had been issued. This put a total and worldwide stop to the merger. Finally, the same Authority allowed the merger to proceed after an investigation that lasted for nine months.

You can assume that the EU Competition Authority will, too, force a complete halt to any activity designed to put the two companies under one hat and this worldwide. Secondly, you can assume that their deliberations would take as long as, if not longer than what happened in the case of Leapfrog. Finally, according to my sources, the odds are that the final verdict will be negative unless the two companies divest major parts of their business in the Fashion Doll and the Action Figure spaces. In other words, the Competition Directorate will likely prohibit the merger if no adequate remedies to the competition concerns have been proposed by the merging parties. Such a decision could of course be appealed to the Luxembourg-based European Court of Justice. However, this court in most cases tends to side with the Commission rather than the litigant companies.

In all this, we must not underrate the influence of European toy companies in this issue. Lego, Simba and Geobra/Playmobil are totally opposed to a merger between Hasbro and Mattel as they see this as an existential threat to their business. They will do whatever it takes to stop this merger from happening.

Whatever the final outcome may be, the time frame for an appeal to the European Court of Justice is measured in years rather than months and the current Hasbro management is likely to reach retirement age well before they see the end result.

Buyer Opposition

National buyers at the large toy retailers - Wal-Mart (NYSE:WMT), Target (NYSE:TGT), ToysRUs, Carrefour and others - dislike monopolies of any kind. The reason is that a monopoly by a vendor lessens the leverage the retailer has in terms of pricing power, promotional allowances, payment terms and so forth. The most recent example of what can happen is in the case of the Leapfrog/VTech merger.

Up to that point, the Learning aisle was completely taken by the two companies and the retailers had no problem with this because they saw two competitors vying for their favor and an advantage in terms of shelf position and shelf space. Once it became clear that this merger was going to happen and the two competitors were combining forces, the retailers - presumably independently of each other - began to try to level the playing field again. They did so by luring major toy manufacturers into the Preschool space - Mattel, Spin Master, Melissa & Doug and others - inviting them to bring appropriate products into the Learning aisle.

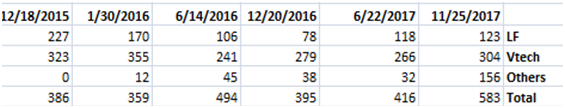

The two companies announced on February 5, 2016, that they had entered into the agreement that VTech would acquire Leapfrog. And this is what happened in terms of shelf space at Wal-Mart, Target and ToysRUs before and after this announcement:

Source: Klosters Retailer Panel

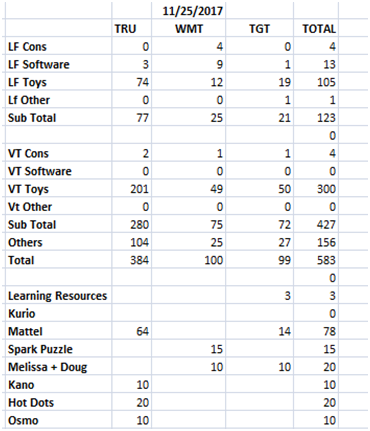

And this is how things looked in detail on 11/25/2017:

Source: Klosters Retailer Panel

What would be the choices the retailers have in the case of a Hasbro/Mattel merger? For one, they could give Lego and Playmobil shelf space in the Action Figure aisle. Secondly, they could invite Simba - whose Steffi Love range is phenomenally successful in Europe - to enter the Fashion Doll space in the U.S. Whatever the retailers finally would choose to do, they would definitely not allow the Hasbro/Mattel combo to monopolize the key toy spaces in their stores.

In summary, I believe that the odds are stacked against this merger going through anytime soon.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.