The Case for Central Bank Electronic Money and the Non-case for Central Bank Cryptocurrencies | St. Louis Fed

Originally posted 2018-02-28

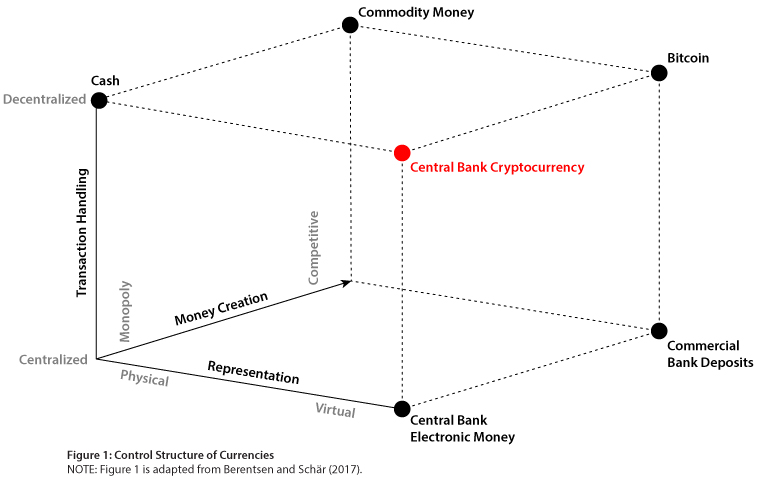

Abstract: We characterize various currencies according to their control structure, focusing on cryptocurrencies such as Bitcoin and government-issued fiat money. We then argue that there is a large unmet demand for a liquid asset that allows households and firms to save outside of the private financial sector. Central banks could offer such an asset by simply allowing households and firms to open accounts with them. Finally, we conclude that a central bank will not issue cryptocurrencies in the sense of a truly decentralized and permissionless asset that allows users to remain anonymous.

1 Control Structure of Currencies

In Berentsen and Schär (2017), we argue that Bitcoin links several technological components together in such a way that the units of value are issued under competition and have both a virtual representation and a decentralized transaction process. In this way, the Bitcoin system has created money that is substantially different from any other money—such as commodity money, cash, or electronic money.

To understand why Bitcoin is unique, it is useful to characterize money according to its control structure as shown in Figure 1.1 There are three dimensions. The first dimension is representation. Money can be represented in virtual form or physical form. The second dimension is transaction handling. Money can be transacted in centralized or decentralized payment systems. Finally, the third dimension is money creation. Some monies are created by a monopoly, while others are issued under competition.

Cash is represented by a physical object, usually a coin or bill, meaning that its value is inseparable from the object. The holder of a cash unit is automatically the owner of the corresponding value. As a result, the ownership rights to the cash units, circulating freely in the economy, are always clearly defined without anyone having to keep records. This feature allows for a decentralized payment system where cash can change hands between two agents without the involvement of a third party. In most countries, the central bank or the treasury is the monopoly issuer of cash.

Commodity money, such as gold, is also represented by a physical object; and, again, the current holder of a unit is by default assigned ownership of the value unit and so no recordkeeping is needed to use it as a payment instrument.2 Gold differs from cash by its competitive creation process because anyone can enter the business of extracting gold and thereby create new gold units.

Commercial bank deposits are virtual money. Virtual money has no physical representation. It exists only as a record in an accounting system. When a payment is made, the accounts are adjusted by deducting the payment amount from the buyer and crediting it to the seller. In most countries, households and firms use commercial bank deposits to make electronic payments. There are many ways to initiate payments; the most common are credit cards, debit cards, checks, and online banking. Commercial banks compete for deposits; that is why we consider the creation of money in the form of commercial bank deposits as competitive (see Figure 1).3 The banks are responsible for keeping records so any transaction between a buyer and a seller requires a commercial bank or several commercial banks to update the respective accounts. For that reason, commercial bank deposits are transacted in a centralized payment system.

Central bank electronic money is also virtual money. In most countries, public access to electronic central bank money is restricted. In Switzerland, for example, it can be held only by a few financial intermediaries. As of now, there are roughly 200 intermediaries that have accounts at the Swiss National Bank and they use the funds in these accounts for settlement purposes and to fulfill reserve requirements.4 A proposal that we label "central bank electronic money for all" would allow all households and firms to open accounts at central banks, which then would allow them to make electronic payments with central bank money instead of commercial bank deposits. (We will come back to this proposal in the next section.) As shown in Figure 1, central bank electronic money is issued monopolistically and transactions are conducted in a centralized payment system.

Bitcoin is the first virtual money for which ownership rights to the various monetary units are managed in a decentralized network. There is no central authority, no boss, and no management. And yet it still works. The Bitcoin blockchain is the decentralized accounting system, and the so-called miners are the bookkeepers. This article won't provide a detailed explanation of this mechanism; see Berentsen and Schär (2018) for that. However, we would like to emphasize that decentralized management of ownership of digital assets is a fundamental innovation. It has the potential to disrupt the current payment infrastructure and the financial system. In general, it could affect all businesses and government agencies that are involved in recordkeeping.

The special feature of cryptocurrencies is that they combine the transactional advantages of virtual money with the systemic independence of decentralized transaction processing. Furthermore, as with gold, the creation of new Bitcoin units is competitive. Anyone can engage in the creation of new Bitcoin units by downloading the respective software and contributing to the system. In practice, however, a few large miners dominate the mining process. The reason is that competition has become fierce and only large mining farms with highly specialized hardware and access to cheap electricity can still make a profit from mining (Berentsen and Schär, 2018).

2 The Case for Central Bank Electronic Money

Each form of money has its benefits and drawbacks. This is why many forms of money coexist. The benefits of cash are that the user can remain anonymous and there is a permissionless access to the cash payment system. In particular, users do not need to open bank accounts to use cash. Furthermore, the decentralized nature of cash transactions makes the cash payment system very robust. It is not possible to destroy it by attacking the payment infrastructure, and people do not need to fulfill any prerequisites to participate. In contrast, centralized payment systems are vulnerable: If the centralized payment processor is attacked, the entire system can come to a halt.5

Cash has another important benefit. With cash there is no credit relationship. Any debt is immediately settled. Therefore, there is no counterparty risk, transactions are final, and people can engage in trade even if they do not trust each other.6 In contrast, today's electronic money (sight deposits issued by commercial banks) involves counterparty risk. Commercial bank deposits are a ledger-based virtualization of claims to physical monetary units (cash). This simply means that bank deposits are a liability of the issuer and bank customers holding bank deposits are offering a credit to their respective bank. Cash has the disadvantage that the buyer and the seller have to be physically present at the same location, which makes its use impracticable for online commerce. The benefit of virtual money such as commercial bank deposits is exactly that it allows for payments among agents that are physically separated. As such, virtual money enables new business opportunities.

Cash is also the only liquid asset for saving outside of the private financial system. By liquid we mean an asset that can be directly exchanged for goods and services. Gold, for example, is also a means for saving outside of the private financial system. However, according to our definition, it is not liquid because it cannot be exchanged directly for goods and services (in most cases).7

We believe there is great demand for a virtual asset issued by a trusted party that can be used to save outside of the private financial system. To underpin this claim, we track Swiss francs in circulation (in the form of cash) as a fraction of GDP from 1980 until 2017 (shown in Figure 2). We can distinguish three phases. The first phase is from 1980 until 1995, when financial innovations replaced the use of cash as a medium of exchange or store of value. The Swiss population increasingly started to use debit and credit cards for payments. The second phase is from 1995 until 2008, when card payments and online banking further expanded but, as suggested by Figure 2, the use of cash did not decline further.

From 2008 until 2017, we see a rapid increase of cash in circulation. We strongly believe that one reason for this increase is the financial crisis of 2007-08 and the subsequent euro crisis. As discussed in Berentsen and Schär (2016), the financial meltdown of 2007-08 and the euro crisis triggered massive interventions by central banks and sharply increased debt-to-GDP ratios in many countries. These events diminished the trust in the financial system, in central banks' ability to function as lender of last resort, and in governments' ability to prevent another financial crisis without having to resort to drastic measures such as confiscatory taxes or forced conversions (as represented by the Greek euro exit discussion).8

After 2008, the demand for cash increased rapidly since it was the only means of holding Swiss francs without facing counterparty risk. Cash was used as an insurance against the insolvency of financial institutions. For example, during the financial crisis, UBS, the largest bank in Switzerland, had to be rescued by the government and the Swiss National Bank.

We believe that there is a strong case for central bank money in electronic form, and it would be easy to implement. Central banks would only need to allow households and firms to open accounts with them, which would allow them to make payments with central bank electronic money instead of commercial bank deposits. As explained earlier, the main benefit is that central bank electronic money satisfies the population's need for virtual money without facing counterparty risk.9 But there are additional benefits.

Cash has many advantages, but its end might be near

There are political and technological reasons why the use of cash may be diminishing. Cash is being condemned by many politicians and economists. According to Berentsen and Schär (2016), the argument of these cash critics essentially is based on three claims: First, the use of cash is inefficient and significantly more expensive than electronic payments. Second, cash promotes crime and facilitates money laundering and tax evasion.10 Third, cash hinders monetary policy by limiting the central bank's ability to use negative nominal interest rates as a policy option.

Technological reasons also apply: In the near future, a close cash substitute will be developed that will rapidly drive out cash as a means of payment. A contender is Bitcoin or some other cryptocurrency. While cryptocurrencies still have many drawbacks, such as high payment fees, scaling issues, and poor adoption, these issues could rapidly disappear with the emergence of large-scale off-chain payment networks (e.g., Bitcoin's lightning network) and other scaling solutions.

If the use of cash is restricted for political reasons or vanishes because of technological innovations, the somewhat strange situation arises that households and firms have no access to legal tender. Today, in most countries, the population can pay only with legal tender through the use of cash. If cash disappears, the population is forced to make all payments with private money. By offering transaction accounts, central banks enable the general public to hold legal tender in electronic form. A large part of the population will consider it a close substitute for cash, and this will make it easier to say goodbye to cash.

"Central bank electronic money for all" increases the stability of the financial system

We believe this because we conjecture that "central bank electronic money for all" would have a disciplining effect on commercial banks.11 To attract deposits, they would need to alter their business model or to increase interest rate payments on deposits to compensate users for the additional risk they assume. The disciplining effect on commercial banks will be reinforced by the fact that, in the event of a loss of confidence, customers' money can be quickly transferred to central bank electronic money accounts. In order to avoid this, the banks must make their business models more secure by, for example, taking fewer risks or by holding more reserves and capital, or they must offer higher interest rates. This simplicity of moving funds to central bank accounts has the potential to create additional volatility. For example, there could be rapid shifts of large quantities of money from commercial bank deposits to central bank accounts that have no real causes (bank panics that are unrelated to fundamentals). In this case, the central bank is called upon to provide commercial banks with the necessary temporary liquidity by offering standing facilities where commercial banks can obtain central bank money against collateral in a fast and uncomplicated way.

"Central bank electronic money for all" simplifies monetary policy and makes it more transparent

The central bank could simply use the interest rate paid on these accounts as its main policy tool. If markets are not segregated, meaning that everyone has access to electronic central bank money, the interest rate on these accounts would be the lowest interest rate in the economy. The reason is that central bank electronic money will be the most-liquid asset in the economy and holders of such money face no counterparty risk since a central bank cannot become illiquid. Many central banks are currently discussing the possibility of normalizing interest rates. Because of the massive amount of liquidity created in response to the financial crisis, standard instruments such as open market intervention are ineffective and all instruments that are currently discussed have the characteristic that the central bank pays, in some form, interest on reserves (see Berentsen, Kraenzlin, and Müller, 2018). There is a political economy issue with these payments since, as of today, they are paid only to the few financial intermediaries that have access to central bank electronic money. The general public might not consider such large payments equitable or beneficial, and there is a high risk that it will trigger political controversies that have the potential to affect central bank independence (see Berentsen and Waller, 2014). Central bank electronic money is an elegant way of avoiding possible political upheavals with regard to these interest payments, by allowing the whole population to have access to these interest payments and not just a small group of commercial banks.

"Central bank electronic money for all" requires low administrative effort

Overall, we believe that implementing "central bank electronic money for all" is straightforward since these accounts can be used only for making payments. No credit can be obtained, and so almost no monitoring is needed. (Of course, some standard regulations would still apply.) All transactions would need to be initiated electronically. Furthermore, many central banks already have a payment infrastructure in operation. For example, the Swiss National Bank already maintains one for its employees. Central bank electronic money for all would imply scaling the existing infrastructure to allow for additional account holders. However, it is not necessary that a central bank provides the infrastructure itself. Legislation could mandate that commercial banks open at least one central bank money account for each of their customers. This would allow customers to use their existing online banking access to initiate transactions from their central bank money account. These accounts would have to be maintained by commercial banks outside their balance sheets. As a result, they do not count as part of a bank's assets in the event it goes bankrupt.

This idea is related to but differs in important ways from the Chicago Plan.12 One key element of the Chicago Plan was to eliminate the fractional reserve system by imposing 100 percent reserves on commercial bank deposits. "Central bank money for all" does not eliminate the fractional reserve system. It only amends it by requiring that all agents have access to central bank electronic money. Commercial banks can continue to offer bank deposits, and no one is forced to use central bank electronic money.

There are many open questions that need to be carefully discussed before this proposal can be implemented. In the case of Switzerland, for example, a decision would have to be made about who may hold an account at the Swiss National Bank. Is it only the Swiss population or can people living abroad have such an account? As a first step, it would make sense to narrowly define the group of users to first gain experience running the system. Furthermore, it would be wise initially to add a cap to limit the amount of money that can be held in these accounts. The benefit of such a cap is that it would allow the Swiss National Bank to gain experience, in particular, with the instruments that need to be in place to refinance the private banking system in case of large-scale bank runs.

3 The Non-case for Central Bank Cryptocurrencies

As shown in Figure 1, the distinguishing characteristic of cryptocurrencies is the decentralized nature of transaction handling, which enables users to remain anonymous and allows for permissionless access. In this section, we argue that it makes little sense for central banks to issue cryptocurrencies even though it would be straightforward from a technological point of view to do so.

In theory, a central bank could easily introduce a central bank cryptocurrency. There exist standards such as Ethereum's ERC20 or ERC223 token standards that can be used to create new fungible tokens that are compatible with the Ethereum blockchain's infrastructure. Alternatively, one could attach additional value components to fractions of existing cryptoassets, such as Bitcoin. The additional value—in this case, fiat currency—would then be part of a specific fraction of a Bitcoin (or more precisely an unspent transaction output) and could be represented and traded on the Bitcoin blockchain. This is usually referred to as "colored coins." Finally, a central bank can develop a brand new blockchain. All approaches are fairly straightforward to implement and would allow for the issuance of a central bank cryptocurrency on a public blockchain.

To ensure parity between a crypto fiat unit and central bank reserves, the central bank must be willing to buy and sell any number of these tokens at par. The valuation will depend on the central bank's credibility; but, if a central bank is determined to issue a central bank cryptocurrency, it would have the means to do so. In fact, the convertibility mechanism can be compared with different denominations of cash, where central banks make a similar claim.13

However, the key characteristics of cryptocurrencies are a red flag for central banks. That is, no reputable central bank would have an incentive to issue an anonymous virtual currency. The reputational risk would simply be too high. Think of a hypothetical "Fedcoin" used by a drug cartel to launder money or a terrorist organization to acquire weapons. Moreover, commercial banks would rightfully start asking why they have to follow KYC ("know your customer") and AML ("anti-money laundering") regulations, while the central bank is undermining any effects of this regulation by issuing an anonymous cryptocurrency with permissionless access. Moreover, cryptocurrency is still a very young technology and there are large operational risks. Overall, we believe that the call for a "Fedcoin" or any other central bank cryptocurrency is somewhat naïve.

Once we remove the decentralized nature of a cryptocurrency, not much is left of it. As shown in Figure 1, virtual money that is centralized and issued monopolistically by a central bank is electronic central bank money. It is worthwhile to mention that electronic central bank money could have been offered a long time ago. The technology for issuing virtual money in a centralized way existed long before the invention of the blockchain. But calling such a centralized form of virtual money a cryptocurrency is misleading.

4 Conclusion

The distinguishing characteristic of cryptocurrencies is the decentralized nature of transaction handling, which enables users to remain anonymous and allows for permissionless access. These key characteristics are a red flag for central banks, and we predict that no reputable central bank would issue a decentralized virtual currency where users can remain anonymous. The reputational risk would simply be too high. Rather, central banks could issue central bank electronic money. This money would be tightly controlled by them, and users would be subject to standard KYC ("know your customer") and AML ("anti-money laundering") procedures.

Some central banks supposedly are evaluating the issuance of a central bank cryptocurrency. However, a closer look at these projects reveals that these are not cryptocurrencies according to our definition in Figure 1. The projects usually are highly centralized.

In general, we don't think that a central bank should be in the business to satisfy the demand for anonymous payments. We believe that such a demand can and will be perfectly satisfied by the private sector, in particular through cryptocurrencies. History and current political reality show that, on the one hand, governments can be bad actors and, on the other hand, some citizens can be bad actors. The former justifies an anonymous currency to protect citizens from bad governments, while the later calls for transparency of all payments. The reality is in between, and for that reason we welcome anonymous cryptocurrencies but also disagree with the view that the government should provide one.

NOTES

1 We focus on Bitcoin, but many other cryptocurrencies share similar characteristics. However, more than 1,500 cryptocurrencies have come into existence in the past few years and some do not feature all the characteristics that we find essential to be qualified as a cryptocurrency (see Figure 1).

2 We abstract from the case where an agent holds a unit of gold and is not the legal owner, such as a bank that keeps gold for its customers in a vault.

3 In some countries, competition for commercial bank deposits is restricted by financial regulations. For these countries, commercial bank deposit creation lies somewhere between monopoly and competition (see Figure 1).

4 For that reason, electronic money issued by the Swiss National Bank is called reserves.

5 A centralized payment infrastructure has many more disadvantages: Plenty of user data are collected, users can be locked out of the system, and their funds can be confiscated, which is all too often the case in countries with dubious legal systems. Furthermore, centralization may lead to a systemic dependence and rent-seeking behavior. Additionally, vendors are in constant fear of chargebacks.

6 Like cash, Bitcoin is not a liability and, therefore, holding Bitcoin involves no counterparty risk.

7 In the finance literature, there are many competing definitions for the term "liquid asset." We use the one developed in the literature labeled "new monetarist economics" (e.g., Williamson and Wright, 2010) and "search theoretic approach to monetary economics" (e.g., Nosal and Rocheteau, 2011; Kiyotaki and Wright, 1993).

8 As discussed in Berentsen and Schär (2016), cash is an insurance against bad outcomes by enabling its holder to remain "liquid" when disaster hits. Financial crises (e.g., the Lehman collapse), confiscatory taxes (e.g., Cyprus and Argentina), or (anticipated) forced conversion (e.g., Grexit, Argentina) are just a few examples of recent events in which holding cash was advantageous. The rapid increase in cash in circulation in Switzerland after the financial crisis cannot be explained only by low interest rates, since Switzerland already had a spell of zero interest rates shortly after the year 2000 when no such increase occurred.

9 A holder of electronic central bank money faces no counterparty risk because a central bank can always print its own liabilities. In contrast, commercial demand deposits are a promise to pay out cash (central bank money) on demand and that promise might not be fulfilled. However, central bank money is not immune to financial disaster. Historically, hyperinflation has impoverished many households that have held a large part of their wealth in the form of cental bank currency (see Berentsen and Schar, 2016).

10 There are many politicians and economists (e.g., Rogoff, 2016) who want to abolish cash because they believe that it is mainly used for criminal activities, money laundering, and tax evasion. If this argument is true, then the Swiss population became less criminal during the 1980s, and then its desire for crime stabilized during the 1990s, and finally, from 2007 on, the Swiss franc was used to conduct more money laundering and tax evasion (see Figure 2). It should be clear by now that we are not convinced by this argument.

11 Note that we believe that central bank electronic money for all will increase the stability of the financial system. In fact, there is a need for research that quantifies the effects of this mechanism on the stability of the financial system.

12 The Chicago Plan was developed during the Great Depression by many leading U.S. economists. It advocated a major monetary reform including 100 percent reserve balances to back commercial bank deposits (see Benes and Kumhof, 2012). A system with 100 percent reserve requirements is essentially identical to a system where commercial banks are forced to hold all deposits in accounts that are separated from their own balance sheet.

13 The most straightforward way to fix the exchange rate would be to offer two standing facilities. For example, assume the Swiss National Bank decides to issue a Swiss franc crypto token on the Ethereum blockchain. To keep the value of this crypto token at par, it would offer a buying facility and a selling facility. At the buying facility, it would promise to buy unlimited amounts of Swiss franc crypto tokens at, say, 0.999 Swiss francs. At the selling facility, it would offer to sell Swiss franc crypto tokens at, say, 1.001 Swiss francs. If these facilities are credible, the value of the Swiss franc token will remain between 0.999 and 1.001 Swiss francs forever. In fact, these facilities will never be used if markets are not segregated, as shown in Berentsen, Kraenzlin, and Müller (2018) for the Swiss money market.

REFERENCES

Benes, Jaromir and Kumhof, Michael. "The Chicago Plan Revisited," IMF Working Paper WP/12/202, International Monetary Fund, 2012.

Berentsen, Aleksander; Kraenzlin, Sébastien and Müller, Benjamin. "Exit Strategies and Monetary Policy." ECON—Working Paper No. 241, Department of Economics, University of Zurich, revised February 2018.

Berentsen, Aleksander and Schär, Fabian. "A Short Introduction to the World of Cryptocurrencies." Federal Reserve Bank of St. Louis Review, First Quarter 2018, pp. 1-16; https://research.stlouisfed.org/publications/review/2018/01/10/a-short-introduction-to-the-world-of-cryptocurrencies.

Berentsen, Aleksander and Schär, Fabian. Bitcoin, Blockchain und Kryptoassets: Eine umfassende Einführung. BoD, Norderstedt, 2017.

Berentsen, Aleksander and Schär, Fabian. "The Fallacy of a Cashless Society," in Beer C., Gnan E., and U.W. Birchler (Hg.), Cash on Trial, SUERF Conference Proceedings 2016/1, Larcier, S. 14-19, 2016.

Berentsen, Aleksander and Waller, Christopher. "Floor Systems for Implementing Monetary Policy: Some Unpleasant Fiscal Arithmetic." Review of Economic Dynamics, 2014, 17(3), pp. 523-42.

Kiyotaki, Nobuhiro and Wright, Randall. "A Search-Theoretic Approach to Monetary Economics." American Economic Review, 1993, 83(1), pp. 63-77.

Nakamoto, Satoshi. "Bitcoin: A Peer-to-Peer Electronic Cash System." 2008; https://bitcoin.org/bitcoin.pdf.

Nosal, Ed and Rocheteau, Guillaume. Money, Payments, and Liquidity. MIT Press, 2011.

Rogoff, Kenneth S. The Curse of Cash. Princeton University Press, 2016.

Williamson, Stephen D. and Wright, Randal. "New Monetarist Economics: Models," Staff Report 443, Federal Reserve Bank of Minneapolis, 2010.

Aleksander Berentsen is a professor of economic theory at the University of Basel and a research fellow at the Federal Reserve Bank of St. Louis. Fabian Schär is managing director of the Center for Innovative Finance at the Faculty of Business and Economics, University of Basel.

© 2018, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Aleksander Berentsen and Fabian Schar, "The Case for Central Bank Electronic Money and the Non-case for Central Bank Cryptocurrencies," Federal Reserve Bank of St. Louis Review, Second Quarter 2018, pp. 97-106. https://doi.org/10.20955/r.2018.97-106