Tyson Foods chief warns African swine fever could reach US | Financial Times

The head of meatpacking company Tyson Foods has warned the “threat is real” that African swine fever could enter the US for the first time, a nightmare scenario for pork exporters.

African swine fever, fatal to pigs but harmless to humans, was discovered in China last August and rapidly moved through the world’s largest pig herd.

Deaths from the disease and culling are likely to cut China’s inventory by more than 100m animals — more than the entire hog inventory in the US.

The looming scarcity in China is expected to reshape international trade in meats, with exporters in Europe, Brazil, Australia and the US, including Tyson, poised to benefit.

“This is an unusual, perhaps unprecedented, time for the protein industry,” Noel White, Tyson’s chief executive, said on a conference call while reporting results on Monday.

“In my 39 years in the business, I’ve never seen an event that has the potential to change global protein production and consumption patterns as African swine fever does.”

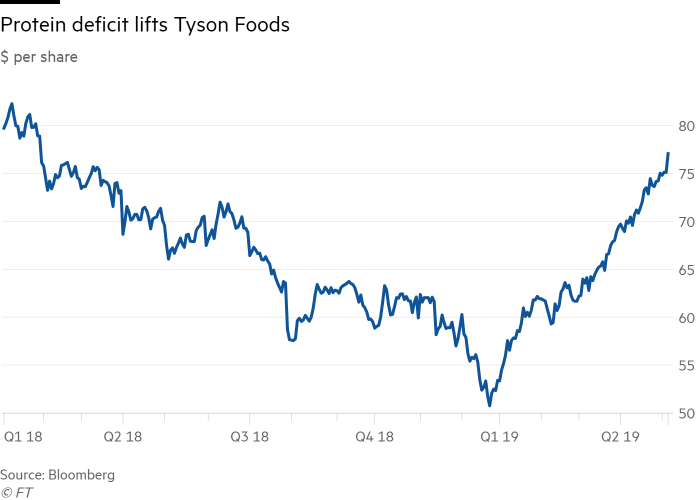

New York-listed Tyson is the largest meat packer in the US, slaughtering hundreds of thousands of cattle and pigs and tens of millions of chickens every week. Shares of Tyson and other meat suppliers such as JBS of Brazil have soared this year as the toll of African swine fever in eastern Asia became known.

For the quarter ended March 30, Tyson reported adjusted earnings of $1.20 per share, down 6 per cent from the same period last year, but 5 cents ahead of consensus estimates.

Management maintained an annual outlook for $43bn in sales and adjusted earnings of $5.75-$6.10 per share, projecting that new demand coming in response to the outbreak of African swine fever would arrive late this fiscal year or in the next one.

Mr White estimated about 150m-200m hogs have died in China because of the disease, reducing global protein supplies by about 5 per cent.

“It's going to benefit all three species: beef, pork and poultry,” Mr White said of the impact on alternative meat sources. Tyson’s shares closed up 2.6 per cent at $77.05, the highest level since January 2018.

However, he spoke in grave terms about the risk that the disease could spread to the 74.3m pigs on US farms, which would immediately shut off American pork exports.

“I think the threat is real. I do think there is a distinct possibility it could come to the United States,” Mr White said.

The virus has no treatment or vaccine and can survive up to a year in blood, faeces and meat, making it difficult to suppress. North American authorities and farm groups have mobilised to prevent the disease from entering the country with stepped-up inspections at ports of entry and other measures.

US sales of pork to China have faced a 62 per cent tariff since last July, imposed by Beijing in retaliation for US duties. China has banned American chicken since a 2015 avian influenza outbreak in the US. Hopes for greater meat exports have risen this spring as negotiators seemed to edge closer to a trade deal.

Tyson in March received US government approval to export pork to China from two slaughterhouses in the towns of Perry and Storm Lake, Iowa, “to make sure we’re positioned to export pork to Chinese customers again,” the company said.

The optimism over US meat exports was clouded by US President Donald Trump’s new threat to raise tariffs on all Chinese goods to 25 per cent this week.

In response, lean hogs futures, which track a key input for Tyson, fell by the daily limit of 3 cents to 89.75 cents per lb Monday in Chicago.