Buffett Snookered: $340 Million Lost In Solar Tax Scheme Raises Questions About BHE - Berkshire Hathaway Inc. (NYSE:BRK.A) | Seeking Alpha

Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B) reportedly lost $340 million in an investment in DC Solar. DC Solar is being accused of being a "Ponzi-like scheme", and Berkshire had to take a $377 million charge in its Q1 2019 report. It made the investments from 2015-2018, and had to reverse income tax benefits that it "recognized weren't valid".

Beyond the headlines, the question is, is this a one-off event, or does it represent some greater risk to Berkshire and the broader investment universe? With tax benefits, incentives, subsidies and guaranteed returns, Berkshire, utilities, and asset allocators have ramped up investments in alternative energy.

After writing an article about Berkshire's potential investment in Occidental Petroleum (OXY), which has subsequently materialized, I got frequent feedback about how surprised investors were about Berkshire's exposure to the regulated and unregulated energy markets. While Berkshire discloses some of that in its 10-k, the unfortunate joke about 10-k's is that "people will do anything to avoid reading a 10-k". And more disclosure is in a presentation in an often overlooked amendment to that 10-k, which is worth perusing in detail.

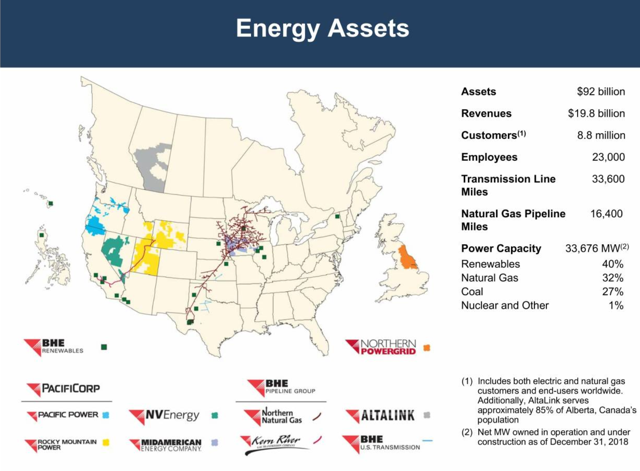

Here is an overview of Berkshire's energy business from that presentation:

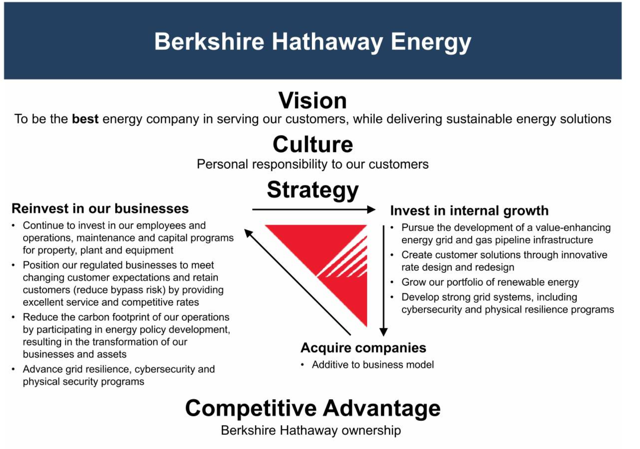

Underlying this set of assets is a strategy:

Unsurprisingly considering Buffett's leadership, the strategy is capital allocation driven, with a focus to: "reinvest in our business" and "invest in internal growth). Focusing on "competitive advantage":

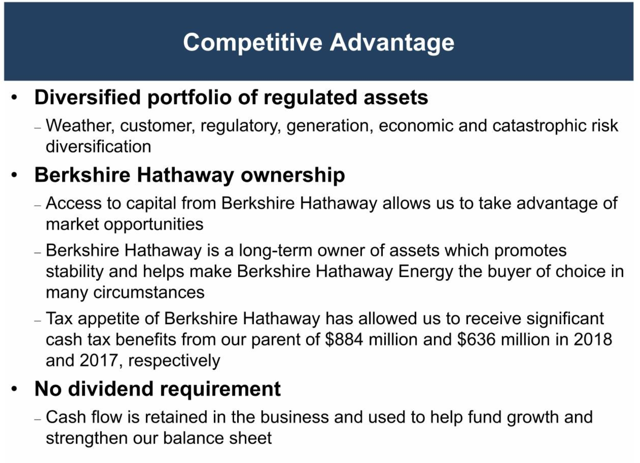

The major "competitive advantage" cited is Berkshire's ownership. It mentions access to capital, long term orientation and management, and "tax appetite", and emphasizes an insurance perspective, having ostensibly diversified away a number of risks. Not surprising for a subsidiary of an insurance-heavy company led one of the most famous and successful investors ever.

However, there is a reason many traditional "value investors" avoid regulated industries: tax arbitrage is often fleeting, and tax shelters can come with high risks. Berkshire was reminded of this with the DC Solar alleged ponzi like scheme and the $377 million charge.

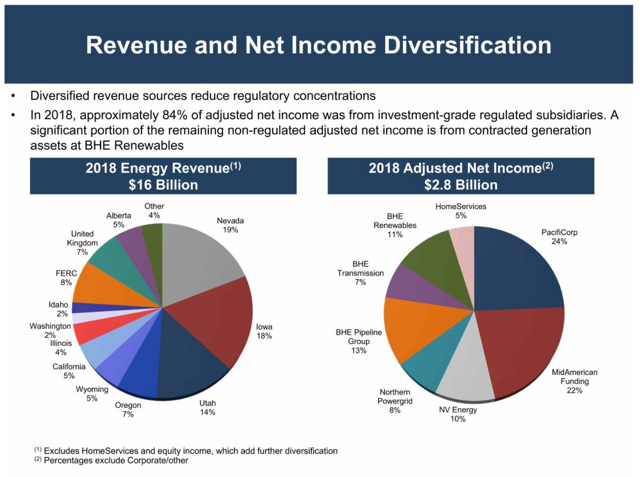

Considering Berkshire's "tax appetite" is a "competitive advantage" for Berkshire Hathaway Energy, perhaps this business is less advantaged if searching for tax benefits leads to multi hundred million dollar losses. And perhaps returns. And with 11% of net income from BHE renewables:

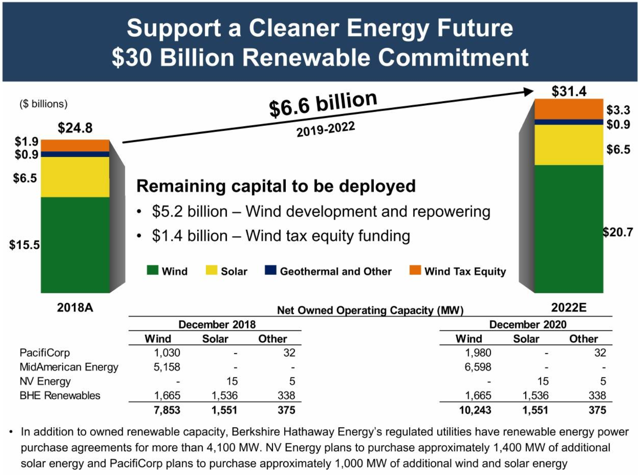

Perhaps BHE's plan to deploy $6.6 billion into renewables in the next 3 years should be re-evaluated:

An interesting observation in the above slide, beyond the risk associated with the capital deployment, is that Berkshire planned to deploy $0 into additional solar assets. Note the $6.5 billion of solar assets in 2018 and in 2022E. Did Berkshire already know there was an issue with DC Solar? If not, why was solar "tax equity funding" deprived of any further capital investment?

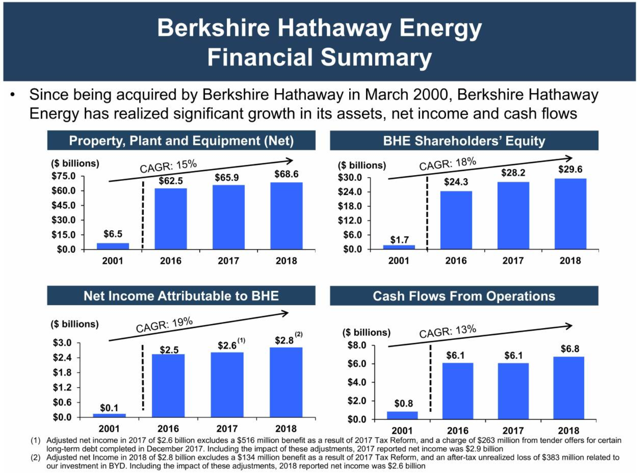

With such a large, poorly understood asset base, and with competitive advantages that are challenged but at least some poor capital allocation, this is worthy of further review. Particularly considering the nearly straight line up to the right increases in net income, shareholders equity, cash flow and pp&e.

This compares to the more volatile performance of the utility sector etf (XLU), reflective of less straight line performance:

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.