The ECASH Act

Digital Privacy / Public Money

The ECASH Act

The Bill

Press Release | Fact Sheet

FAQ

Other Resources

In the Media

About

On March 28, 2022, Rep. Stephen Lynch (MA-08), Chair of the House Committee on Financial Services' Task Force on Financial Technology, introduced H.R. 7231 - The Electronic Currency and Secure Hardware (ECASH) Act (full text here).

The ECASH Act is co-sponsored by Rep.'s Jesús G. “Chuy” García (IL-04), Rashida Tlaib (MI-13), Ayanna Pressley (MA-07), and Alma Adams (NC-12) of the Committee on Financial Services, and endorsed by Americans for Financial Reform, Demand Progress, the Action Center on Race and the Economy (ACRE), and Public Money Action.

The bill directs the Secretary of the Treasury to develop and pilot digital dollar technologies that replicate the privacy-respecting features of physical cash, in order to promote greater financial inclusion, maximize consumer protection and data privacy, and advance U.S. efforts to develop and regulate digital assets.

For a list of media coverage, click here.

return to top

Frequently Asked Questions

1. What does the ECASH Act do?

4. What is a bearer instument?

5. Does E-Cash involve blockchain or distributed ledger technology?

6. What distinguishes E-Cash from other forms of digital money?

7. Why use E-Cash over other forms of digital money/payments?

8. Why issue this via the Treasury and not the Federal Reserve?

11. Are there any limits to the use of E-Cash?

14. Won't digitally minting E-Cash be inflationary?

15. Doesn't this undermine Monetary Policy and threaten Federal Reserve independence?

return to top

1. What does the ECASH Act do?

The ECASH Act:

- 1. Directs the Secretary of the Treasury to develop and introduce a form of retail digital dollar called “e-cash,” which replicates the offline-capable, peer-to-peer, privacy-respecting, zero transaction-fee, and payable-to-bearer features of physical cash, and to coordinate their efforts with other agencies, including the Federal Reserve through an intergovernmental Digital Dollar Council led by the Treasury Secretary;

- 2. Establishes an Electronic Currency Innovation Program within the U.S. Treasury to test and evaluate different forms of secure hardware-based e-cash devices that do not require internet access, third-party validation, or settlement on or via a common ledger, with a focus on widely available, interoperable architectures such as stored-value cards and cell phones;

- 3. Establishes an independent Monetary Privacy Board to oversee and monitor the federal government’s efforts to preserve monetary privacy and protect civil liberties in the development of digital dollar technologies and services, and directs the Treasury Secretary to, wherever possible, promote and prioritise open-source licensed software and hardware, and to make all technical information available for public review and comment; and

- 4. Establishes a special-purpose, ring-fenced Treasury overdraft account at the Federal Reserve Bank of New York to cover any and all government expenses related to the development and piloting of E-Cash, and directs the Board of Governors of the Federal Reserve System to take appropriate liquidity-support measures to ensure that the introduction of e-cash does not reduce the ability of banks, credit unions, or community development financial institutions to extend credit and other financial services to underserved populations, as prescribed under the Community Reinvestment Act of 1977 and related laws.

2. What is E-Cash?

The ECASH Act defines e-cash as a currency instrument that is:

- 1. Legal tender issued by the U.S. Treasury, and a general obligation of the United States, not included in calculations of public debt subject to limit under the debt ceiling;

- 2. A bearer instrument distributed directly to, and able to be owned, held, and used directly by the general public via secured hardware devices, and capable of instantaneous, final, direct, peer-to-peer, offline transactions that do not involve or require subsequent or final settlement on or via a common or distributed ledger, or any other additional approval or validation by the United States Government or any other third-party payments processing intermediary;

- 3. Interoperable with all existing financial institution and payment provider systems and generally accepted payments standards and network protocols, as well as other public payments programs, and any other digital dollar or public banking products;

- 4. Designed and administered to replicate the anonymity and privacy-respecting features of physical cash to the greatest extent reasonably and practically possible, including being classified and regulated in a manner similar to physical currency, and thus not subject to third-party exemptions to a reasonable expectation of privacy as is the case for account-based monies;

- 5. Designed and administered to promote equity and justice for historically marginalized communities and excluded populations, and to prioritize universal access and usability, particularly for individuals with disabilities, low-income individuals, and communities with limited access to the internet or telecommunications networks.

Importantly, E-Cash is

not:

- 1. A CBDC (Central Bank Digital Currency). Although E-Cash is a form of digital dollar, it is issued by the Treasury, not the Federal Reserve, and accordingly is not a CBDC.

- 2. In competition with a CBDC. E-Cash is intended to complement and be developed in parallel to other forms of digital public finance, including CBDCs, FedAccounts, Postal Banking, and Public Banking.

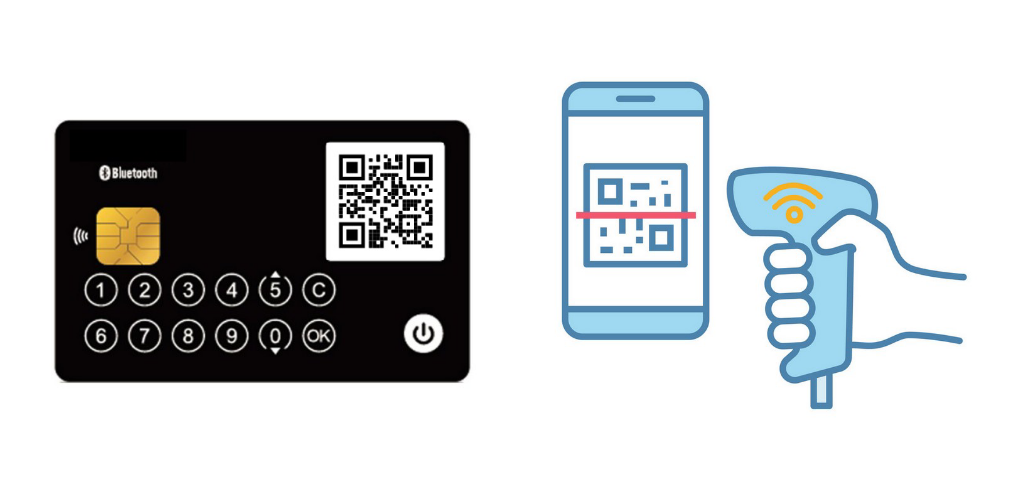

3. What is an E-Cash device?

An E-Cash device is any piece of secured hardware issued and/or authorised by the government for the purpose of receiving, holding, and transferring e-cash balances.

In contrast to ledger-based systems (including those that use a blockchain and/or distributed-ledger rather than a centralized ledge), which prevent double-spending by verifying unspent balances against a common record of all previous transactions, e-cash devices verify funds locally via a dedicated or trusted computing environment located on the device itself.

This allows it to facilitate both offline and genuine peer-to-peer transactions without generating transactional data or requiring the approval of third party intermediaries or network validator nodes.

There are a variety of potential forms such devices may take, which is why the ECASH Act directs the U.S. Treasury to experiment with multiple pilot designs simultaneously.

However, the most common forms, and thus most likely to be adopted initially, are a payments card and a secured chip environment on a cell phone.

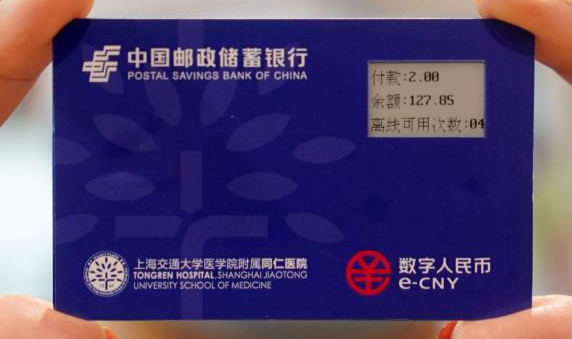

For example, this is the offline-capable smart payments card that was

introduced in China in 2021as part of its digital Yuan rollout, :

This is the Avant stored-value card, which was capable of anonymous, peer-to-peer payments using a custom-made card reader device. It was was issued by the Bank of Finland in 1992, making it (arguably) the world's first Central Bank Digital Currency.

4. What is a bearer instrument?

A bearer instrument represents a legal obligation to pay whoever has legitimate physical possession of the instrument.

Many forms of monetary obligations have circulated as bearer instruments over the millennia, including paper notes, wooden tally sticks, and more recently, electronic value claims stored on secured hardware devices or recorded on open ledgers.

Bearer instruments are typically contrasted with account-based monies, where the right to payment is established via authentication of a person’s identity by a third-party intermediary.

A distinct but related legal concept is that of “currency.” As monetary law expert and Cambridge Law Professor David Fox explains:

Currency is a special legal attribute which allows a recipient of money to take a fresh legal title which is good against the whole world.return to FAQ return to topMoney passes into currency in this way when it is received by a bona fide purchaser for valuable consideration. At this point the title of any previous owner of the money from whom it may have been stolen is extinguished.

It helps money to circulate readily in the economy in that it reduces the need for recipients to make detailed inquiries into the title of people who tender money in payment of debts or to buy goods.

5. Does E-Cash involve blockchain or distributed ledger technology?

No. In contrast to most cryptocurrencies like Bitcoin and Ethereum, E-Cash is a true bearer instrument. Consequently, E-Cash transactions do not involve or require settlement via a blockchain or distributed ledger.

Instead, an E-Cash transaction works by transferring an e-cash balance, which is a unique digital representation of value issued and verified by the government, from one secure hardware device to another. The hardware devices themselves, as well as the security measures undertaken by government at the point of original issue, are responsible for preventing double-spending and counterfeiting.

For more information, see the secure hardware-related technical materials in the Other Resources section below.

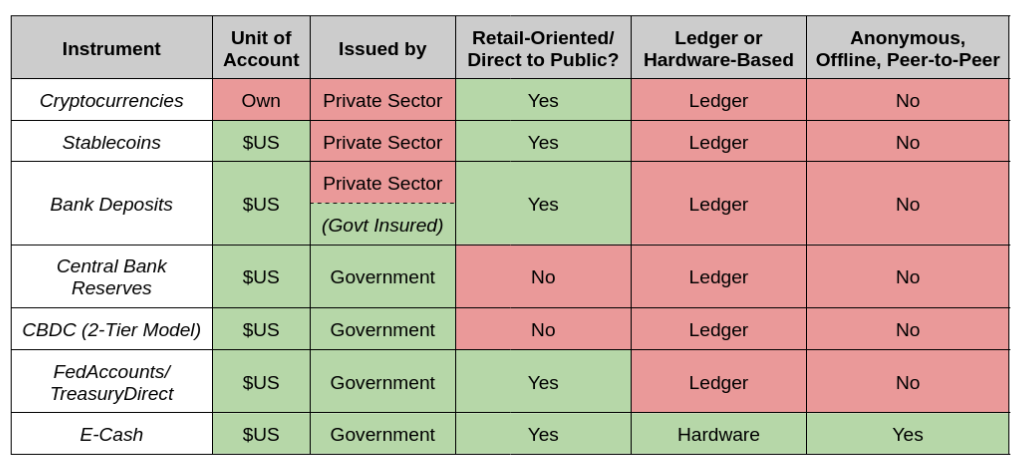

return to FAQ return to top6. What distinguishes E-Cash from other forms of digital money?

E-Cash is the only form of digital currency that is simultaneously:

- 1. Denominated in U.S. dollars;

- 2. Issued and guaranteed by the U.S. government;

- 3. Available for retail use by the public;

- 4. Not reliant on a common ledger or any third-party payments processing intermediary; and

- 5. Capable of anonymous, offline, peer-to-peer payments.

return to FAQ

return to top

return to FAQ

return to top7. Why use E-Cash over other forms of digital money/payments?

E-Cash is well-suited to individuals who:

- 1. Lack access to traditional banking/payments services;

- 2. Value privacy and wish to avoid surveillance and/or data-mining;

- 3. Are concerned about third-party censorship and/or discrimination;

- 3. Lack reliable internet or digital network connectivity; and

- 5. Are low-income and/or cannot afford high transaction, withdrawal, and exchange fees.

On the other hand, E-Cash, like physical cash, does not pay interest, and offers less third-party protections than traditional bank accounts or payments app (chargebacks, loss and fraud-prevention, etc).

Consequently, even though most people will probably choose to keep some day-to-day spending money in the form of E-Cash, they are unlikely to invest all of their life savings into it. return to FAQ return to top

8. Why issue this via the Treasury and not the Federal Reserve?

The Treasury has historically been responsible for designing, issuing, and securing physical currency like coins (via the Mint) and notes (via the Bureau of Engraving and Printing), as well as hardware-secured forms of retail digital money, like pre-paid debit cards and stored value cards (via the Bureau of the Fiscal Service).

Moreover, the Treasury has experience with administering large-scale retail payments programs, as well as coordinating inter-agency responses to systemically important financial technologies and industries. In addition, it possesses the the institutional expertise and political legitimacy to navigate a complex balancing act between privacy, security, law enforcement, and civil liberties interests.

Indeed, the Treasury was arguably the first agency to explore the possibility of issuing a hardware-secured, privacy-respecting form of E-Cash. As Law Professor Rohan Grey noted in his testimony to the U.S. House Committee on Financial Services' Task Force on Financial Technology Hearing on "Digitizing the Dollar: Investigating the Technological Infrastructure, Privacy, and Financial Inclusion Implications of Central Bank Digital Currencies" on June 21, 2021:

In 1995, the Electronic Money Task Force of the Treasury Department proposed the creation of a study commission into the creation of a Mint-issued digital currency card, as part of Vice President Gore’s broader National Performance Review initiative to “reinvent government” in light of emerging internet and other digital technologies.In an October 1995 hearing before the House Banking Committee on Domestic and International Monetary Policy on the topic of “The Future of Money,” then-Director of the U.S. Mint, Philip Diehl, testified that the Mint’s “main interest in the evolution of payments system is ... focused on stored value cards as a potential substitute for coins and currency.”

Diel Further noted that: “As sole provider of the nation’s coinage, the Mint has an important role in our monetary system. As the use of stored value cards evolves, many consumers might be expected to replace coinage and currency transactions with ‘e-cash’ transactions, thus creating a new de facto form of currency...

It is [thus] appropriate to ask the question whether at some point in the future the requirements of market efficiency could accelerate the federal government’s role in producing a stored value card that would augment the use of coinage in commercial transactions.

By contrast, the Federal Reserve has been researching and exploring the possibility of issuing a Central Bank Digital Currency, or "CBDC," for some time, and up until this point it has shown little interest, if not outright hostility, towards a CBDC model that is 1) capable of anonymous payments, 2) structured as a legal bearer instrument, 3) issued directly to the public, and 4) built on secure hardware.

For example, in January of 2022, the Federal Reserve released its long-awaited CBDC report, in which it noted that "the Federal Reserve Act does not authorize direct Federal Reserve accounts for individuals, and such accounts would represent a significant expansion of the Federal Reserve’s role in the financial system and the economy."

Consequently, it recommended the adoption of an "intermediated model", whereby the "private sector [including commercial banks and regulated nonbank financial service providers] would offer accounts or digital wallets to facilitate the management of CBDC holdings and payments [and] operate in an open market for CBDC services."

In addition, the Federal Reserve noted that:

Financial institutions in the United States are subject to robust rules that are designed to combat money laundering and the financing of terrorism. A CBDC would need to be designed to comply with these rules.Similarly, in February 2022, the Federal Reserve Bank of Boston and the Massachusetts Institute of Technology Digital Currency Initiative released a Report on Phase 1 of their collaborative Project Hamilton, titled "A High Performance Payment Processing System Designed for Central Bank Digital Currencies," in which they noted thatIn practice, this would mean that a CBDC intermediary would need to verify the identity of a person accessing CBDC, just as banks and other financial institutions currently verify the identities of their customers.

[...] In this regard, a CBDC would differ materially from cash, which enables anonymous transactions."

Offline payments We have not yet explored the potential for payments using CBDC without an Internet connection. Our transaction format and data model requires interactive communication between the central bank and both transacting parties.Moreover, the Federal Reserve by its own admission has limited institutional capacity to provide retail payments services directly, and lacks the institutional expertise or political legitimacy to make decisions regarding how to balance civil liberties and law enforcement/national security interests on behalf of the broader public.One option is to operate a parallel system using trusted hardware requiring no connectivity with the central bank to conduct a transaction. Trusted hardware would be responsible for enforcing the authenticity of CBDC while outside central bank systems, and thus vulnerable to supply chain attacks or end-user tampering.

Instead, the Federal Reserve System is staffed primarily by economists trained in statistically modelling, not privacy, national security, or law enforcement experts.

Although there is broad political support for "central bank independence" nowadays, such independence has always been historically centered around issues of monetary policy (ie interest rates), not defining the future of money for the entire nation over the objections and concerns of elected officials.

To the contrary, such questions are deeply political, and consequently are best to Congress and the political executive branch, ie the President and Treasury Secretary.

9. Is E-Cash really secure?

No technology is 100% safe. As with physical currency, there will always be some degree of counterfeiting and fraud risk associated with physical devices capable of being held and used locally by the end-user in offline situations.

That said, secure hardware technologies have been around for decades, and there are many companies and research teams working on different models and approaches.

The ECASH Act directs the Treasury to make all software and hardware used in the development of E-Cash technology available under an appropriate open-source license.

Moreover, by hardwiring denominational (and potentially transactional) limits into the E-Cash devices themselves, policymakers will be able to reduce the possibility of individual hacks causing systemic vulnerabilities.

return to FAQ return to top10. Is E-Cash really private?

The struggle to preserve and defend privacy and individual liberties is ongoing, and cannot be won solely through technical means.

That said, the ECASH Act represents a major step towards protecting transactional privacy during the transition to a digitally native fiat currency regime. It does so by:

- 1. Directing the Treasury Secretary to "preserv[e] the privacy, anonymity-respecting, and minimal transactional data-generating properties of physical currency instruments...to the greatest extent technically and practically possible" when implementing E-Cash, including by securing E-Cash devices "locally via cryptographic encryption and other appropriate technologies;"

- 2. Requiring E-Cash devices be secured "locally via cryptographic encryption and other appropriate technologies," and prohibiting them from "contain[ing] or be[ing] subject to any surveillance, personal identification or transactional data-gathering, or censorship-enabling backdoor features;"

- 3. Requiring that any E-Cash technology be "capable of instantaneous, final, direct, peer-to-peer, offline transactions using secured hardware devices that do not involve or require subsequent or final settlement on or via a common or distributed ledger, or any other additional approval or validation by the United States Government or any other third-party payments processing intermediary;"

- 4. Requiring E-Cash be classified and regulated in a manner similar to physical currency for the purposes of anti-money laundering, know-your-customer, counter-terrorism, and transaction reporting laws, and thus not subject to third-party exemptions to a reasonable expectation of privacy;

- 5. Prohibiting the U.S. government, as well as other counterparties or E-Cash distributors, from collecting, monitoring, or retaining data from E-Cash transactions unless explicitly authorized to do so under the ECASH Act, and prohibiting the acquisition, possession, or use of E-Cash from being being treated as prima facie or intrinsic evidence of criminal activity or intent; and

- 6. Establishing an independent five-member Monetary Privacy Board, and directing the Board to review, evaluate, and periodically report on the extent to which the decisions and actions of the Treasury Secretary and other actors involved in the development of E-Cash are 3 consistent with their statutory responsibilities under the ECASH Act, and more broadly, a general commitment to preserving the privacy interests of individuals and actors that use e-cash and other forms of digital dollar technologies issued or administered by the

United States government.

11. Are there any limits to the use of E-Cash?

E-Cash is primarily intended for use by individuals, and does not exempt any person or entity from financial reporting requirements or compliance with existing criminal and civil laws.

Although the ECASH Act does not specifiy a specific per-device denominational or transactional cap, it is expected that such limits will ultimately be incorporated into the final E-Cash design following the pilot phase, similar to how physical currency has denominational caps today.

return to FAQ return to top12. Won’t the widespread adoption of E-Cash lead to an outflow of deposits from the traditional banking system, thereby reducing the availability and increasing the cost of credit?

No. E-Cash is intended to fill the social role historically played by physical currency, which represents a relatively small fraction of overall monetary activity.

Indeed, most people prefer to keep most of their money in a bank, where it earns interest and is protected from fraud, theft, or loss.

Consequently, it is unlikely that the introduction of E-Cash will result in a noticeable outflow of deposits from the traditional banking system.

However, in the event this were to occur, the bill directs the Board of Governors of the Federal Reserve System to "take appropriate measures to ensure that the implementation and adoption of e-cash does not disrupt or substantially impact the general availability or cost of liquidity" or the "exten[sion of] credit and other financial services to underserved populations," provided that such measures "in no way impair, restrict, or otherwise limit the ability of the public to access, hold, and use e-cash."

return to FAQ return to top13. How is the bill funded?

The ECASH Act establishes permanent, ongoing appropriations authority for spending undertaken in furtherance of E-Cash, with the specific amount to be determined by the Treasury Secretary on an ongoing basis.

This spending is not funded via taxes or the issuance of public debt.

Instead, the bill directs the Federal Reserve Bank of New York to establish a special, ring-fenced overdraft account for the Treasury, and to exempt that account from standard accounting rules, in order to grant the Treasury a similar degree of operational flexibility in developing its digital dollar program as the Federal Reserve enjoys with its research and operational budget.

return to FAQ return to top14. Won't digitally minting E-Cash be inflationary?

No. Like physical currency, the issuance of E-Cash will adjust automatically based on consumer demand.

Moreover, there is little difference in inflationary impact between money-financed and "debt"-financed public spending.

return to FAQ return to top15. Doesn't this undermine Monetary Policy and threaten Federal Reserve independence?

No. The Federal Reserve will continue to exercise full control over interest rates, liquidity management, and the size of its balance sheet following the introduction of Treasury-issued E-Cash, just as it does today with Treasury-issued coinage, and as it did for over 50 years during which Federal Reserve Notes and U.S. Notes were issued in parallel.

Inteed,

Other Resources

Secure Hardware-Based Digital Currency Technologies

- Mihai Christodorescu et al. (2021), Towards a Two-Tier Hierarchical Infrastructure: An Offline Payment System for Central Bank Digital Currencies, Visa/Cornell University

- Teddy Kyung Lee (2021), CBDC Wallets and the Security Requirements, Global Semiconductor Alliance

- Whispercash (2022), Whispercash

- Whispercash (2022), Offline CBDC: Product Brochure

- eCurrency Mint (2022), eCurrency

- eCurrency Mint (2020), DSC3 - Digital Symmetric Core Currency Cryptography

- Thomas Kudrycki (2020), Blockchain is the wrong technology choice for delivering Central Bank Digital Currency (CBDC)

- Mitch Cohen (2020), CBDC and Privacy Concerns

- Jonathan Dharmapalan & Rohan Grey (2017), The Macroeconomic Policy Implication of Digital Fiat Currency

- Kelly Le & Mengyuan Ge (2021), China tests new phone-free DCEP e-RMB card for helping rural poor

- PingWest (2021), Hardware Wallets for China's Digital Yuan Sprung up During Spring Festival

- U.S. Treasury, Bureau of the Fiscal Service (2022), EagleCash

- Mark Orders-Woempner (2019), New EagleCash consolidates DoD’s stored-value cards

- Aleksi Grym (2020), Lessons learned from the world’s first CBDC, Bank of Finland

- John Miedema et al (2020), Designing a CBDC for Universal Access, Bank of Canada

- Sarah Allen et al (2020), Design choices for Central Bank Digital Currency: Policy and technical considerations, Brookings Institute

- #MintTheCoin! - Interview with Former Mint Director Philip N. Diehl, Public Money Action (Oct. 8, 2021) (Transcript | Video)

- Rohan Grey, Testimony before the U.S. House of Representatives Committee on Financial Services' Task Force on Financial Technology Regarding "Digitizing the Dollar: Investigating the Technological Infrastructure, Privacy, and Financial Inclusion Implications of Central Bank Digital Currencies" (July 15, 2021)

- Raúl Carrillo, Testimony before the U.S. House of Representatives Committee on Financial Services' Subcommittee on Consumer Protection and Financial Institutions Regarding “Banking Innovation or Regulatory Evasion? Exploring Trends in Financial Institution Charters” (April 15, 2021)

- Raúl Carrillo (2020), Banking on Surveillance: The Libra Black Paper, Demand Progress/Americans for Financial Reform

- Jerry Brito (2019), The Case for Electronic Cash, CoinCenter

- Jerry Brito (2020), Central banks are wrong to say that CBDCs must be built to comply with AML regulations

- Jerry Brito (2020), More on CBDCs, AML, and anonymity in electronic cash

- Hamed Aleaziz (2022), ICE Conducted Sweeping Surveillance Of Money Transfers Sent To And From The US, A Senator Says, Buzzfeed News

- Jay Stanley (2019), Say No to the “Cashless Future” — and to Cashless Stores, ACLU

- Sherrod Brown (2020), Privacy Isn’t a Right You Can Click Away, Wired

- Peter Coy, Does the End of Cash Mean the End of Privacy?, New York Times (March 30, 2022)

- Elise Hansen, Democrats' Digital-Cash Bill Emphasizes Financial Privacy, Law360 (March 29, 2022) (paywalled)

- Robert D. Knight, House Committee Chair Proposes Privacy-Preserving Digital Currency, BeInCrypto (March 29, 2022)

- National Association of Federally-Insured Credit Unions, Legislation introduced proposing Treasury issue digital dollar (March 29, 2022)

- Jose Oramas, US Lawmakers Pass E-Cash Bill That Replicates Physical Money, Leaving Aside the FED, CryptoPotato (March 29, 2022)

- Joe Weisenthal, Five Things You Need to Know to Start Your Day, Bloomberg (March 29, 2022)

- The Hash, House ‘ECASH’ Bill Can Fast Track CBDC Adoption in US, Coindesk TV (March 29, 2022)

- Max Slater-Robins, US lawmakers want to trial a digital dollar, TechRadar Pro (March 29, 2022)

- Phil Rosen, Lawmakers have introduced a bill that would allow the US Treasury to create a digital dollar, Business Insider (March 29, 2022)

- Gary Guthrie, Legislators introduce E-cash as a way to digitize the American dollar, Consumer Affairs (March 29, 2022)

- Zach Marzouk, Democrats propose privacy-focused digital dollar, IT Pro (March 29, 2022)

- Mary Brenda, US House Committee Chair proposes a bill to create “E-Cash” digital dollar, Cryptopolitan, Cryptopolitan (March 29, 2022)

- Lynne Marek, Congress mulls a different digital dollar, Payments Dive (March 29, 2022)

- Liam Tung, Can digital dollars be as anonymous as cash? It's time to find out, say lawmakers, ZDNet (March 29, 2022)

- Sam Sutton, Lynch introduces plan for Treasury to issue digital cash, Politico Pro (March 28, 2022)

- Adi Robertson, A new bill would launch a large-scale test of digital dollars, The Verge (March 28, 2022)

- Pymnts, House Bill Calls for Creation of Crypto-Less, Privacy-First Dollar, PYMNTS (March 28, 2022)

- Jeff Benson, Congress Is Discussing a Digital Dollar Pilot. It's Not What You Think, Decrypt (March 28, 2022)

- Brooks Butler, Members of Congress Introduce "E-Cash" Bill, CryptoBriefing (March 28, 2022)

- Izabella Kaminska, The CBDC That's Not a CBDC, The Blind Spot (March 28, 2022)

- Gilad Edelman, The Future of Digital Cash Is Not on the Blockchain, Wired (March 28, 2022)

- Brendan Rearick, ECASH Bill Sets the Stage for a U.S. Central Bank Crypto, InvestorPlace (March 28, 2022)

- Paul Amery, US legislators want Treasury, not Fed to run digital dollar, New Money Review (March 28, 2022)

- Nikhilesh De, US Lawmakers Introduce 'ECASH' Bill in New Push to Create a Digital Dollar, CoinDesk (March 28, 2022)

- Alex Graf, Rep. Stephen Lynch introduces bill to create Treasury-issued digital currency, S&P Global Market Intelligence (March 28, 2022)

- William Saas & Max Seijo, The ECASH Act with Rohan Grey, Money on the Left (March 28, 2022)

- Izabella Kaminska, Will the US Treasury rescue the world from a CBDC panopticon?, The Blind Spot (March 28, 2022)

- Kollen Post, New bill tasks Treasury, not Fed, with digital dollar issuance, The Block (March 28, 2022)

- Andrew Singer, US e-cash: Bill proposes digital currency that replicates cash, bypasses the Fed, CoinTelegraph (March 28, 2022)

- Thomas Claburn, Dems propose privacy-respecting digital dollar, The Register (March 28, 2022)

- Andrew Ross Sorkin et al, Should Uncle Sam Mint Electronic Cash?, New York Times - Dealbook (March 28, 2022)

return to Other Resources return to top